Friday, January 30, 2009

What is Personal Accident ?

ING PERSONAL ACCIDENT

Be Prepared For the Unexpected

Comprehensive Personal Accident (PA1)

PA1 offers you :

Comprehensive protection for permanent disablement including full or partial payment for dismemberment due to accident.

Coverage for accidental death.

Weekly indemnity for temporary disablement due to accident.

Medical expenses arising out of accidental injury.

Double indemnity for accidents in public transport, elevators or fire in public buildings.

Additional coverage for natural death.

Eligibility : For ages 16 to 55 years old.

Accidental Death & Dismemberment (PA2)

PA2 offers you :

Comprehensive protection for permanent disablement including full or partial payment for dismemberment due to accident.

Coverage for accidental death.

Double indemnity for accidents in public transport, elevators or fire in public buildings.

Additional coverage for natural death.

Eligibility : For ages 16 to 55 years old.

Accidental Death / Disability (PA3)

PA3 offers you :

Protection for total and permanent disablement due to accident.

Coverage for accidental death.

Double indemnity for accidents in public transport, elevators or fire in public buildings.

Additional coverage for natural death.

Eligibility : For ages 16 to 55 years old.

Blue Collar Accidents (PA4)

PA4 offers you :

Comprehensive protection for permanent disablement including full payment for dismemberment due to accident.

Coverage for accidental death.

Weekly indemnity for temporary disablement due to accident.

Double indemnity for accidents in public transport, elevators or fire in public building.

Additional coverage for natural death.

Eligibility : For ages 16 to 55 years old.

Juvenile Personal Accidents (PA4)

JPA offers you :

Comprehensive protection for permanent disablement including full payment for dismemberment due to accident.

Lifetime annual maintenance benefit for total & permanent disability due to accident.

3% increase in sum insured for accidental death and disability at every renewal.

Medical expenses benefit for accidents.

Coverage for accidental death.

Double indemnity for accidents in public transport, elevators or fire in public building.

Additional coverage for natural death.

Eligibility : For ages 30 days to 15 years old.

Be Prepared For the Unexpected

Comprehensive Personal Accident (PA1)

PA1 offers you :

Comprehensive protection for permanent disablement including full or partial payment for dismemberment due to accident.

Coverage for accidental death.

Weekly indemnity for temporary disablement due to accident.

Medical expenses arising out of accidental injury.

Double indemnity for accidents in public transport, elevators or fire in public buildings.

Additional coverage for natural death.

Eligibility : For ages 16 to 55 years old.

Accidental Death & Dismemberment (PA2)

PA2 offers you :

Comprehensive protection for permanent disablement including full or partial payment for dismemberment due to accident.

Coverage for accidental death.

Double indemnity for accidents in public transport, elevators or fire in public buildings.

Additional coverage for natural death.

Eligibility : For ages 16 to 55 years old.

Accidental Death / Disability (PA3)

PA3 offers you :

Protection for total and permanent disablement due to accident.

Coverage for accidental death.

Double indemnity for accidents in public transport, elevators or fire in public buildings.

Additional coverage for natural death.

Eligibility : For ages 16 to 55 years old.

Blue Collar Accidents (PA4)

PA4 offers you :

Comprehensive protection for permanent disablement including full payment for dismemberment due to accident.

Coverage for accidental death.

Weekly indemnity for temporary disablement due to accident.

Double indemnity for accidents in public transport, elevators or fire in public building.

Additional coverage for natural death.

Eligibility : For ages 16 to 55 years old.

Juvenile Personal Accidents (PA4)

JPA offers you :

Comprehensive protection for permanent disablement including full payment for dismemberment due to accident.

Lifetime annual maintenance benefit for total & permanent disability due to accident.

3% increase in sum insured for accidental death and disability at every renewal.

Medical expenses benefit for accidents.

Coverage for accidental death.

Double indemnity for accidents in public transport, elevators or fire in public building.

Additional coverage for natural death.

Eligibility : For ages 30 days to 15 years old.

Friday, January 16, 2009

It's all about ING

About ING Group

ING Insurance Berhad is part of the ING Group, an international financial services institution of Dutch origin. With a staff force of approximately 120,000 employees, ING Group provides banking, insurance and asset management to over 60 million customers in more than 50 countries. As of the end of 2006, the Group had investment assets under management of EUR600 billion, total assets worth EUR1,227 billion and shareholders’ equity equalling EUR38 billion.

About ING Malaysia

As part of the global financial giant, ING Group, ING Malaysia can provide our customers with the best products and services. ING Malaysia provides all classes of insurance ranging from life insurance, general insurance and employee benefits plus investment management which includes unit trusts and fixed rate home loans. ING Malaysia has the financial strength, experience, service centre network, as well as a team of well-trained staff and agents to serve its over 1.5 million customers nationwide. As at the end of 2006, its total asset worth was RM8.7 billion, with a paid-up capital of RM140 million

ING’s commitment to our clients

The international recognition and strength of the ING brand sets a strong foundation for our relationship with our customers. The entire Group shares the same goal, which is for our customers to count on us as a dependable leader in offering comprehensive financial services. We are also proud of the diversity of financial products and services we offer Malaysians. From life insurance, general insurance, fixed rate home loans, employee benefits and Unit Trust investments from ING Funds, our customers can easily put together a complete wealth protection management and accumulation package according to their needs.

ING ensures client satisfaction

Equally important is client satisfaction. We are committed to offering fast and convenient help through different channels, including an online Policy Enquiry Service (Click), 24-hr Personal Customer Services Hotline (Call), and Customer Service Counter Assistance (Face). Our focus is on training our people to ensure they possess the highest-quality tools and skills necessary to meet customers’ needs. We make this extra effort so that our customers receive the best service from us, whatever they want, whenever they please.

ING’s involvement in Community Projects

In Malaysia, we actively support communities through sponsoring local projects in running sports, children’s theatre and fundraising to benefit children with special needs because we believe in contributing to the long term sustainability of the community we do business in. From 2007 onwards, ING will continue to strengthen our corporate citizenship through our new community initiative, Chances For Children where we will be working with partners within the field of children’s education. As ING is committed to helping people manage their future, we want to ensure that we extend this principle to our nation’s children through a major investment in primary education projects.Because, by providing children with a proper education, ING can help them manage their own future.

ING – The Premium International Brand

On a global level, ING Group has recently announced that ING will be the title sponsor of the highly successful Renault F1 Team for three years beginning 2007. The ING Renault F1 Team will enter the Formula 1 Grand Prix at the beginning of the 2007 Championship. Grand Prix races take place in 17 countries, of which ING is active in 15. With a total television audience of around 850 million people per year, Formula 1 will provide ING with a strong global platform to further strengthen our premium international brand appeal, particularly in ING's key growth markets including Malaysia. ING's brand has grown strongly in customer recognition and has climbed to 85th position in the 2006 Interbrand Best Global Brands List. Formula 1 and the Renault F1 Team are associated with teamwork, winning performance and achieving permanent progress, which fit well with the positioning of ING. ING is convinced that teaming up with the Renault F1Team will significantly raise ING's global brand awareness around the world.

ING Insurance Berhad is part of the ING Group, an international financial services institution of Dutch origin. With a staff force of approximately 120,000 employees, ING Group provides banking, insurance and asset management to over 60 million customers in more than 50 countries. As of the end of 2006, the Group had investment assets under management of EUR600 billion, total assets worth EUR1,227 billion and shareholders’ equity equalling EUR38 billion.

About ING Malaysia

As part of the global financial giant, ING Group, ING Malaysia can provide our customers with the best products and services. ING Malaysia provides all classes of insurance ranging from life insurance, general insurance and employee benefits plus investment management which includes unit trusts and fixed rate home loans. ING Malaysia has the financial strength, experience, service centre network, as well as a team of well-trained staff and agents to serve its over 1.5 million customers nationwide. As at the end of 2006, its total asset worth was RM8.7 billion, with a paid-up capital of RM140 million

ING’s commitment to our clients

The international recognition and strength of the ING brand sets a strong foundation for our relationship with our customers. The entire Group shares the same goal, which is for our customers to count on us as a dependable leader in offering comprehensive financial services. We are also proud of the diversity of financial products and services we offer Malaysians. From life insurance, general insurance, fixed rate home loans, employee benefits and Unit Trust investments from ING Funds, our customers can easily put together a complete wealth protection management and accumulation package according to their needs.

ING ensures client satisfaction

Equally important is client satisfaction. We are committed to offering fast and convenient help through different channels, including an online Policy Enquiry Service (Click), 24-hr Personal Customer Services Hotline (Call), and Customer Service Counter Assistance (Face). Our focus is on training our people to ensure they possess the highest-quality tools and skills necessary to meet customers’ needs. We make this extra effort so that our customers receive the best service from us, whatever they want, whenever they please.

ING’s involvement in Community Projects

In Malaysia, we actively support communities through sponsoring local projects in running sports, children’s theatre and fundraising to benefit children with special needs because we believe in contributing to the long term sustainability of the community we do business in. From 2007 onwards, ING will continue to strengthen our corporate citizenship through our new community initiative, Chances For Children where we will be working with partners within the field of children’s education. As ING is committed to helping people manage their future, we want to ensure that we extend this principle to our nation’s children through a major investment in primary education projects.Because, by providing children with a proper education, ING can help them manage their own future.

ING – The Premium International Brand

On a global level, ING Group has recently announced that ING will be the title sponsor of the highly successful Renault F1 Team for three years beginning 2007. The ING Renault F1 Team will enter the Formula 1 Grand Prix at the beginning of the 2007 Championship. Grand Prix races take place in 17 countries, of which ING is active in 15. With a total television audience of around 850 million people per year, Formula 1 will provide ING with a strong global platform to further strengthen our premium international brand appeal, particularly in ING's key growth markets including Malaysia. ING's brand has grown strongly in customer recognition and has climbed to 85th position in the 2006 Interbrand Best Global Brands List. Formula 1 and the Renault F1 Team are associated with teamwork, winning performance and achieving permanent progress, which fit well with the positioning of ING. ING is convinced that teaming up with the Renault F1Team will significantly raise ING's global brand awareness around the world.

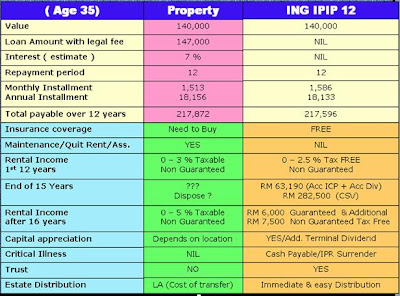

FD, Property or ???

Saving at right time in a right plan .

ING have various type of saving solutions based on your income range and saving capability.

Most common method to save money will be :-

1. Fixed Deposit account (FD)

2. Buying property.

This is a comparison , which I would like to highlight compare to property investment. This is calculated based on a person who is 35 years old.

If you are looking forward for an investment which you can see your money grow without any hassle , this will be the best solution.

GUARANTEED FIXED RATE for lifetime.

Why not SAVE your fund here.

Thursday, January 8, 2009

Why " Medical Card is IMPORTANT ?

Medical Card is important to take care your hospitalisation and surgical expenses . This card is important to ease your financial burden whenever facing uncertainities .

ING "Cashless Medical Card

· Hassle free admission with no deposit required;

· All hospital bills will be settled upon discharge at panel hospitals;

· Comprehensive & secure – full payment of bills;

· Prompt treatment; best facility & immediate attention;

· Hospital room and board and/or Intensive Care Unit (ICU);

· Surgical and anaesthetic expenses;

· Pre-hospitalisation diagnostic and pre-surgery diagnostic services;

· Hospitalisation expenses are inclusive of;

· Specialist/Physician’s fees;

· X-Ray & Laboratory Tests;

· Medication, Drugs & Dressing;

· Operation Room;

· Other ancillary services and supplies

· Hospital administrative charges & Service Tax

· Out of Hospital Benefits – Full reimbursement basis of the following;

· Accidental treatment – outpatient clinical expenses arising from accident and follow-up treatment

· Outpatient cancer treatment

· Outpatient kidney dialysis treatment

· Post-hospitalisation treatment incurred during the follow-up treatment up to 60 days

· Day-care surgery expenses & follow-up up to 60 days

· Home nursing care;

· In-hospital cash benefit – lump sum cash benefit per disability

Protect yourself & your family with our

“CASHLESS” ING Medical Card

· 100% Coverage

· NO Cost Sharing!!!

· Pre Hospitalisation & Post Hospitalisation Coverage

· Cash Income Even Hospitalised

Subscribe to:

Posts (Atom)